High Expectations: Managing For Value In The Automotive Industry

After a long stretch of undershooting investors’ expectations for Economic Profit (EP) growth and Total Shareholder Returns (TSRs), OEMs find themselves in an unfamiliar role: high performers.

Automotive OEMs have historically struggled to deliver the typical profit growth expectations set for most industries. The automotive industry’s high capital intensity, narrow margins and long product cycles challenged companies’ ability to consistently grow EP.

However, as new-vehicle supply tightened, expectations for battery-electric vehicles (BEV) rose, vehicle pricing increased and investor expectations began to rise.

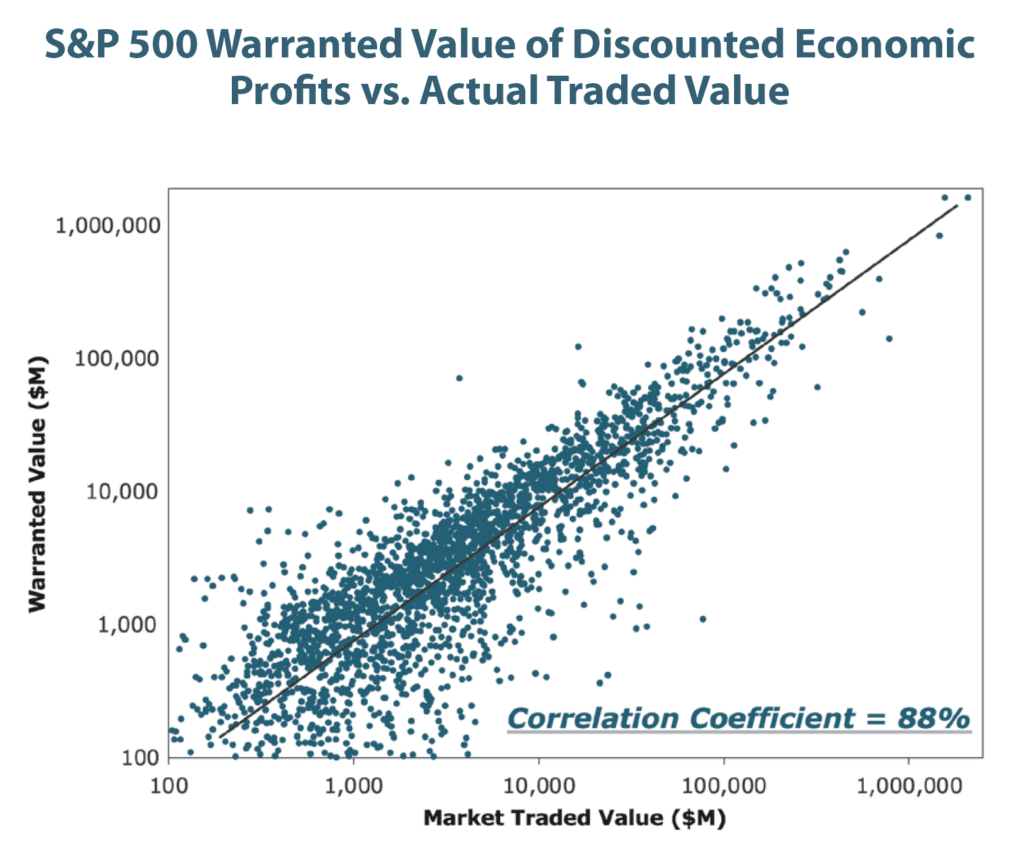

The best measure of a company’s success is delivering superior shareholder returns compared to its industry peers. Since shareholder value is driven by investor expectations of future cash flow and EP growth (See S&P 500 Warranted Value of Discounted Economic Profits vs. Actual Traded Value chart, below), EP has been used as the profitability metric for AlixPartners’ Automotive Value Creation study.

To sustain the recent increase in their TSRs, OEMs, like any other public company, will need to exceed investors’ already-high expectations for EP growth.

CHARTING THE MOMENTUM

To understand the backdrop, consider the three-year period leading up to January 2020. During this time, the industry’s EP growth was challenged as margins were squeezed by declining global volumes and high fixed costs.

How To Do Digital Transformation The Right Way

Major sectors of manufacturing are embracing digital transformation for their own reasons and at…

0 Comments2 Minutes

November 17, 2022

Future-Proofing Your End-To-End Supply Chain For 2023

The storm clouds are gathering, threatening much worse than the current cold drizzle. Bank of…

0 Comments2 Minutes

November 17, 2022

Leveraging software offerings means looking beyond price

Your company’s software license renewal is right around the corner, and you are anticipating a…

0 Comments2 Minutes

November 15, 2022

Five Predictions For The Workplace Of The Future

In predicting the future of work or the future in general, we are extrapolating based on what we…

0 Comments1 Minutes

November 12, 2022