How To Handle Difficult Leadership Team Members

As unfortunate as it might sound, there seems to be at least one difficult member on most leadership teams. We all know the profile—they struggle to collaborate, feel like they are always right, and dismiss others’ perspectives. In fact, there has been quite a bit written about dealing with difficult people at work. While I agree with much of it, I think the solutions often are a bit simplistic.

Of course, toxic executives who are unethical or demeaning to others have no place in any organization and as challenging as it might be they should be counseled out. However, solutions aren’t quite as straightforward when dealing with high performing, talented senior leaders who frequently display difficult behaviors. I recognize that this notion goes against current conventional wisdom, but the reality is that superior senior leadership talent and expertise is worth a great deal to any organization and can sometimes outweigh the pattern of difficult behaviors individuals might exhibit. I am not suggesting that bad behaviors should not be dealt with, but I am submitting that ‘just fire him’ or ‘demote her’ are much easier to say than to do.

Read the original article from ChiefExecutive.net

Measuring ESG

June 2022 | Senior Leadership

Determining corporate value has never been an exact science. But the growing practice of including non-financial factors has made valuation even more complex. For many investors, so-called ESG (environment, social, and governance) issues are now being considered along with discounted cash flows and asset valuation, as is evident by the ESG questions posed in the last analyst earnings calls of 25 percent of companies in the S&P 500. “But,” says Wharton management professor Witold Henisz, “at the same time, people don't feel they have the data and the insight to know how to measure it.”

If you’re a director or senior executive, that means those ESG questions, which are also being asked by employees and other stakeholders, can be very difficult to answer. “We are still developing the tools, the systems, and the processes to value ESG,” says Henisz. “Being tempted by a simplistic answer today can be an expensive mistake. But that doesn’t mean you can’t address ESG concerns and be able to convey your progress to those asking the questions.”

The History of ESG Measurement

Henisz explains that thus far, measuring ESG has been about two different types of ratings. The first simply identifies and creates a checklist of “good” and “bad” companies to help investors who want to avoid specific things like landmines and fossil fuels in their portfolio.

Read the original article here

PwC on Positioning Your Chief Sustainability Officer for Success

Originally published at strategy-business.com. PwC is a Hall of Fame company.

Companies have been appointing chief sustainability officers (CSOs) at a brisk pace recently, and it’s no wonder. With net-zero deadlines on the horizon, investors increasingly want to understand the impact companies have on our environment — and the related risks. Regulatory oversight is growing. Even consumers and employees are raising their expectations. To take the lead, companies appointed almost as many chief sustainability officers in 2020 and 2021 as they did in the previous eight years. Among 1,640 companies around the world we analyzed for the report by PwC and Strategy&, PwC’s strategy consulting business, roughly eight in ten of them have now designated an executive with at least some responsibility for sustainability.

Empowered CSOs, with a broad remit and organizational stature, can wield fact-based insights across a deep network to influence both strategy and operations with respect to sustainability. They can make ESG risks and opportunities clear, addressing a macro-level concern that many senior managers, including most US board directors, admit to not understanding very well — even if they do increasingly perceive the connection to strategy. They also can accelerate the kind of transformation companies will need to keep pace with investor and consumer expectations, as well as with regulations and the competition.

Read the original article here

Inflation outlook hinges on future wage growth: Summers

Dive Brief:

- The outlook for the highest inflation rate in four decades hinges on whether the tight U.S. labor market continues to fuel the fastest increase in wages since the early 1980s, according to former Treasury Secretary Lawrence Summers.

- “I don’t think there’s a durable reduction in inflation without a meaningful reduction in wage growth,” Summers said Tuesday. “Right now with the labor market so tight, I don’t see such a meaningful reduction in wage growth.”

- The U.S. economy may be headed toward a downturn, Summers warned during a Washington Post webcast. “When inflation has been above 4%, unemployment has been below 4%, we’ve always had a recession within the next two years,” he said. “The likelihood is that we’re not going to get through this with a soft landing.”

Dive Insight:

CFOs for months have raised compensation as pandemic lockdowns and reluctance among workers to rejoin the labor force shrunk the pool of available labor. The employment cost index during the first quarter rose 1.4% for a 4.5% year-over year increase.

In April, the consumer price index increased 8.3% year-over-year, while the Fed’s preferred measure of inflation — the core personal consumption expenditures price index — rose 4.9%, according to the Labor Department.

The persistent price pressure increases concerns that consumer expectations for low long-term inflation will fade, prompting demands for higher pay and triggering a self-reinforcing upward spiral in prices and wages.

Read the original article from CFO DIve

The 10 Brands With the Best (and Worst) Reputations in the US

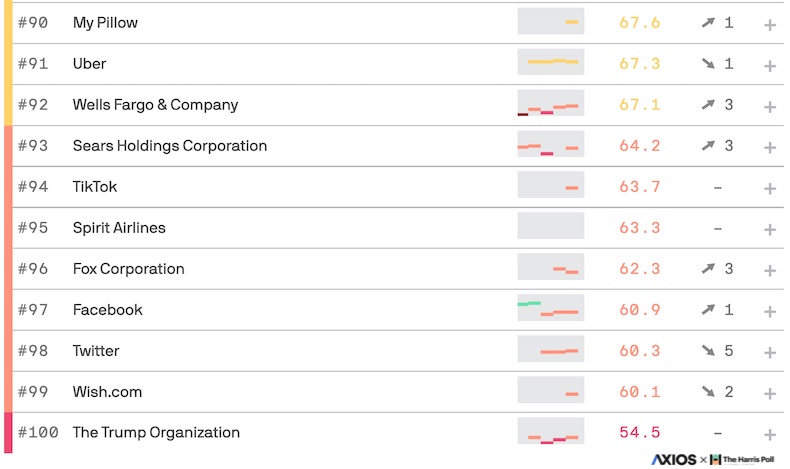

Of all major brands, Trader Joe's has the best reputation among US consumers, according to recent research from Axios and The Harris Poll.

The report was based on a two-step process. First, the researchers surveyed a nationally representative sample of Americans to determine the 100 brands that are most top-of-mind with the public. Next, a nationally representative sample of 33,096 US adults rated the most visible brands across seven key dimensions of reputation. Each brand was then assigned a reputation score between 1 (critically bad reputation) and 100 (excellent reputation).

Trader Joe's tops the list with a score of 82.4.

HEB Grocery ranks second and is followed by Patagonia, The Hershey Company, Wegmans, Samsung, Toyota, Amazon, Honda, and Sony.

The Trump Organization, with a 54.5 score, has the worst reputation among US consumers.

Wish.com has the second worst reputation, followed by Twitter, Facebook, Fox, Spirit, TikTok, Sears, Wells Fargo, Uber, and My Pillow.

About the research: The report was based on a two-step process. First, the researchers surveyed a nationally representative sample of Americans to determine the 100 brands that are most top-of-mind with the public. Next, a nationally representative sample of 33,096 US adults rated the most visible brands across seven key dimensions of reputation. Each brand was then assigned a reputation score between 1 (critically bad reputation) and 100 (excellent reputation).

4 Steps to Avoid Micromanagement in Remote Work

Examples of Micromanaging

First, let’s talk about what micromanaging is not. Managers who micromanage rarely hold animosity or ill will toward the employees they manage. They do not abuse their employees with unprompted negative reviews or resort to public ridicule. Most managers who micromanage don’t even realize they’re doing it because it looks innocent, like this…

Reluctantly, a manager assigns an employee a project. A day or two later, the manager asks for a progress report. They aren’t happy with an “it’s going fine.” They need to know everything done up to that point. The employee spends additional time going over their work and the manager allows the project to continue.

The manager, not happy though with the specific way the employee is working, asks to be CC’d on all future communications involving the project. When a decision needs to be made, the manager steps in and insists on being the one to make it. When the project is completed, the manager reviews the work and corrects the mistakes without sharing their changes or solutions with the employee.

The above demonstrate some examples of micromanaging and next we’ll identify why this practice has mostly negative effect on employee motivation and engagement.

Is Micromanaging a Problem?

Yes; micromanaging in the workplace is definitely problematic in the way it makes employees feel and how it impacts their performance.

Read the original article from Dale Carnegie

Are cover letters antiquated during the Great Resignation?

But is it quick enough during the Great Resignation, in which companies across the United States are experiencing historic turnover. More than 60 million Americans have quit their jobs over the past year, according to the U.S. Bureau of Labor Statistics. Prompted by the pandemic to re-evaluate their priorities in life, workers have been leaving their positions for greener pastures, demanding higher salaries, better working conditions, improved work-life balance and more opportunities to advance their career.

In March, more Americans than ever before – 4.54 million – fled their employer. That’s an increase of 152,000 from February and higher than the former record of 4.53 million in November 2021. The professional and business services sector, as well as the construction industry, saw the most resignations.

A survey by recruitment solutions firm Yello found that 73% of companies use talent acquisition software such as Applicant Tracking System (ATS), Job boards software and Recruitment CRM software. But even so, some hiring managers still prefer to receive a cover letter over other online application processes like Easy Apply because they believe it influences the quality of applicants. For example, University of Texas’ senior lecturer of management Kristie Loescher told BBC recruiters may get a lot of applications from people who are “just out there fishing.” Hence, a cover letter proves candidates care about that specific role.

Do you rely on cover letters in the hiring process? Share your feedback here.

Financial Planning | Process, Importance & Objective

Financial planning is the process of meeting financial objectives through a sound plan that is tailored to your specific needs. Financial planning encompasses more than just investments, and it's more than a one-time event. Your plan may change over time as your needs change and new opportunities arise.

Financial planning allows you to determine what you want to do with your money. It allows you to save toward specific goals and help to reduce taxes, lower debt, and build wealth. Through an understanding of your current situation and future needs, you can ensure your hard work and accumulated assets will last for years to come.

This includes the proper management of funds and investments; setting up systems to track and review transactions; creating a budget; maintaining records, statements, and files based on your specific needs.

Objective of financial planning

Here are some of the main objectives of financial planning to make your business grow.

- Estimating capital requirements

Capital requirements are typically defined as the amount needed to support a financial plan, which can be calculated by summing projected assets and liabilities. Capital requirements can also be viewed in terms of insurance coverage needs and the cost of living expenses.

Capital requirements are the funds a business needs to operate and grow. They include inventory, equipment, buildings, non-operating assets such as goodwill and other intangible assets, and debt.

- Estimating capital structure

Capital structure is the mix of long-term and short-term debt, plus equity capital used to finance a firm's assets. The capital structure should be estimated as one of the main objectives of financial planning. The capital structure entails the sources from which funds are obtained, their respective proportions, and the costs associated with each. Capital structure can be planned and estimated by analyzing companies’ performance in terms of profitability and liquidity

- Crafting financial policies

The next objective of financial planning in the queue is seeking to frame the policies of cash control, lending, borrowing, etc. These decisions are made by business owners primarily based on their own experience and intuition. Although no one can claim these policies are right or wrong, they can only be applied to future situations with a degree of uncertainty because no two future situations will ever be identical since they depend heavily on external factors beyond our influence.

- Inspecting Financial Resources Is Maximally Used

Financial planning is a process that helps to solve problems in the management of financial resources. A finance manager ensures that the scarce financial resources are maximally used in the best feasible manner at the least expenditure to get the ultimate ROI. This can be achieved through proper planning, utilization of available resources, and acceptance of responsibility for decisions taken during this process.

Financial Planning Process

Creating a financial plan is essential to the survival of your business. Financial planning helps you to establish a realistic plan designed to achieve your goals and maintain your investments. The process is thoroughly discussed below. This can help you make the right decisions to ensure that your company grows steadily over time and is stable even in difficult times.

Preparing financial planning can become overwhelming and confusing, especially if it is not done correctly. This guide will walk you through the financial planning process steps, so you're never lost again with all the material you need to start making your business grow in the right way.

- Determine your Financial Situation

First, identify your financial situation. Know where you stand, what you owe, and how to get out of debt. If you have no debt, that is great! Now you can start a savings plan. If you have debt, find out how much time and money it will take to pay off your debt in the next year or two by cutting expenses and increasing income. It is important to understand the financial situation of your business and where you want to go from there.

- Determine Financial Goals

Determining your Financial Goals is the second step in the financial planning process. Financial Goals make up a life plan that lays out the milestones you want to achieve and how you'll use your money to get there. This will help you set realistic objectives, prioritize your financial goals and make sure you are on track with your plan.

This can include both short-term and long-term goals, as well as financial planning for major purchases that you'll be making over the next several years.

- Identify Alternatives for Investment

The third step in the financial planning process is Identifying Alternatives for Investment. There are many alternatives available to you such as bank savings, stocks and bonds, mutual funds and annuities, life insurance, and real estate. The objective of this step is to identify an appropriate amount of liability protection that your finances allow.

During this step, you will learn about various investment options available to you including stocks, bonds, mutual funds, and ETFs. An investor can invest in several different ways, but each has its advantages and disadvantages. Simply speaking, there are three types of investments: cash deposits, bonds, and stocks.

Investing is a decision that carries a great deal of risk – and the potential for reward.

- Consider Alternatives

The fourth step in the financial planning process is Evaluate Alternatives. This can be a confusing time, but no matter what kinds of questions you have, or what stage in life you're at, it's never too early or too late to start planning for your financial future. In this step, you need to identify, compare and contrast various ways to achieve your goals and objectives. Think about the various available options.

- Place Together a Financial Plan & Execute

Your financial planner will use the information gathered during the first four steps of the process to determine your risk tolerance, figure out how much money you'll need to retire, and develop a budget that will help you make sure you're saving enough for retirement. The plan should include details on your income sources, expenses, and savings goals.

Your financial plan is the best way to get started on your road to retirement and so much more. It gives you a detailed process for achieving your goals, along with the confidence and motivation to make it happen.

- Review, Re-evaluate and Monitor The Plan

Reviewing, re-evaluating, and monitoring your financial plan is an essential step in the process. Tracking your progress in these areas allows you to see how you're faring and whether or not you need to make any adjustments. By reviewing your situation regularly, you'll be able to keep your plan relevant to your daily life.

Importance of Financial planning

- It helps you understand what your financial goals are. It can help you to work on achieving them and make the most out of your money.

- It aims to provide you with a path to achieve your goals while minimizing the negative effects of unexpected occurrences which may hinder your progress.

- Financial Planning assists in providing a good balance between inflow and outflow of funds so that equilibrium is conserved.

- It reduces tensions on varying market trends which can be easily encountered through enough funds.

- It helps in decreasing the uncertainties which can be a burden on the company's development. It aids in providing strength and profitability in concern.

The Bottom Line

Financial planning is all about understanding your short, medium, and long-term goals to determine how much capital you need to achieve those goals, and then making sure you have the right mix of income, savings, and investments that will help you get there. There are lots of financial forecasting software for small businesses and enterprises to make businesses grow.

Thus, financial planning is an ongoing process. It will never end as long as you are working to better your financial situation, and meeting objectives and goals.

How To Overcome Return to Office Resistance in 2022

What do the numbers say about return to office resistance?

Many leaders and managers believe that it’s time to return to the office in 2022. But it seems most workers disagree. In a 2022 study by Ivanti, 87% of workers indicated they do not want to return to the office full-time, and 45% of those workers don’t want to return to the office at all. Return-to-office resistance is real. And, if you’re not careful, resistance could easily change to resignation.

Rather than jumping ahead with forcing employees to start in-person work again, it’s essential to understand why this return to office resistance exists and do our best as a company or leader to overcome these objections. So, why won’t people want to go back to work?

Why are employees hesitant to return to the office?

- Health & Safety

At the start of the pandemic, social distancing and masking became commonplace. And not everyone is ready to give up these safety measures or risk their health in an in-office setting. And it isn’t just about Covid-19. Instances of the flu in the US dropped 98% when these public health measures were in place. No one likes being sick, and in-person work (without accompanying safety measures) increases the chances of catching any number of illnesses.

- Work-Life Balance Flexibility

Before the pandemic, companies tried their best to produce work/life balance for employees. But balance doesn’t look the same for everyone, and there is no one-size-fits-all solution.

Read the original article from Dale Carnegie

How “Digital Nomad” Visas Can Boost Local Economies

More and more companies are offering their employees the option to “work from anywhere,” whether in their home office, in another state, or even halfway around the globe. A growing group of remote professionals are taking the “anywhere” in work-from-anywhere to new lengths. These “digital nomads” leverage their remote jobs to allow them to live in tourist hotspots or tropical destinations for months at a time. Others engage in months-long “work-cations,” combining periods of working and tourism. During the Covid-19 pandemic, many countries — especially those with significant tourism sectors suffering from reductions in global travel — began offering specific visas to these digital nomads. It’s abundantly clear that digital nomads, and remote workers in general, can be a boon to any economy— spending money, facilitating collaboration and spurring innovation — a win-win for both the digital nomads and the economies where they choose to live and work.

Work-from-anywhere, where workers enjoy the flexibility to live in a geography of their choice, is here to stay, and countries around the world are in a race to attract the growing class of international remote workers known as “digital nomads.” Portugal, for example, now offers a two-year renewable residence visa for workers who can prove that they have a remote job for the length of their stay. Other countries that offer a form of digital nomad visas include Australia, Czech Republic, UAE, Estonia, Germany, Thailand, Indonesia, Italy, Spain and Brazil, among many others.