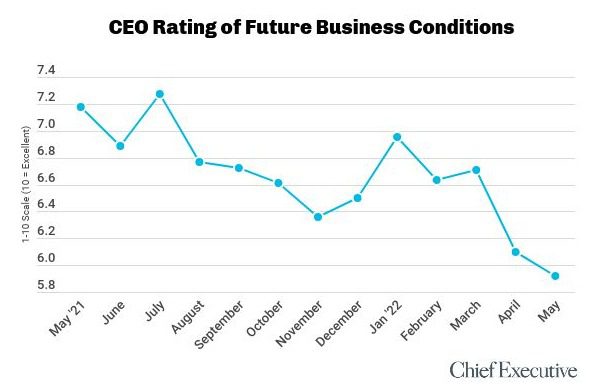

May Poll Finds CEO Optimism At Lowest Level In Almost 6 Years

Sector & Size View

Ratings for future business conditions varied widely by industry this month, with CEOs in financial services giving conditions the highest rating at a 6.3/10, up 4 percent since April.

“There was plenty of liquidity in 2020 & 2021, the US treasury and the administration printed $6 trillion. High equity reserves, corporate and individual savings. The wealth transfer for the next 10 to 15 years will be in trillions. There will be a return to reasonable IRR/yields to investment,” says George Gelis, President at Surge Financial Group, Inc. He rates future business conditions as a 9/10.

CEOs in real estate who rate future conditions as the lowest of the bunch, giving them a 4/10, are worried about inflation and supply chain issues, as well as a lack of available talent.

One CEO in real estate says, “There is poor productivity due to remote work and hybrid work. All companies have had to expand hiring needs with limited real revenue growth and inefficiencies,” to explain why he rates future conditions as a 3/10.

The rating of CEOs in professional services dropped by 14 percent month over month, due to continued inflation and dampening demand because of higher prices. CEOs in industrial manufacturing also suffered a blow to their optimism, with their rating falling by 7.5 percent since April. They have been navigating rising energy prices, the race for talent and global supply chain disruptions.

How To Do Digital Transformation The Right Way

Major sectors of manufacturing are embracing digital transformation for their own reasons and at…

0 Comments2 Minutes

November 17, 2022

Future-Proofing Your End-To-End Supply Chain For 2023

The storm clouds are gathering, threatening much worse than the current cold drizzle. Bank of…

0 Comments2 Minutes

November 17, 2022

High Expectations: Managing For Value In The Automotive Industry

After a long stretch of undershooting investors’ expectations for Economic Profit (EP) growth and…

0 Comments1 Minutes

November 16, 2022

Five Predictions For The Workplace Of The Future

In predicting the future of work or the future in general, we are extrapolating based on what we…

0 Comments1 Minutes

November 12, 2022